Navigating the Volatility of Freight: A Stock Broker's Perspective

We sat down to analyze the volatility of freight. Find out more here.

Monday, July 29, 2024

In today's world, the volatility of freight has reached unprecedented levels, leaving many companies grappling with how best to manage their logistics costs. Traditionally, companies have approached freight procurement much like an annual ritual, negotiating the best possible price and locking it in for the year. However, given the current market dynamics, this approach may no longer be viable. Drawing parallels with stock market strategies, it's worth questioning if this method is still the best way to handle such a volatile commodity.

The Reality of Freight Volatility

The past few years have been a testament to the unpredictability of the global supply chain. From the COVID-19 pandemic to geopolitical tensions, a series of disruptive events have forced shippers to rethink and redesign their distribution networks. According to the Council of Supply Chain Management Professionals’ (CSCMP) annual State of Logistics report, shippers have become accustomed to a "permanent volatility" in their logistics operations. This new normal demands a more agile and flexible approach to managing freight.

How Volatile is freight?

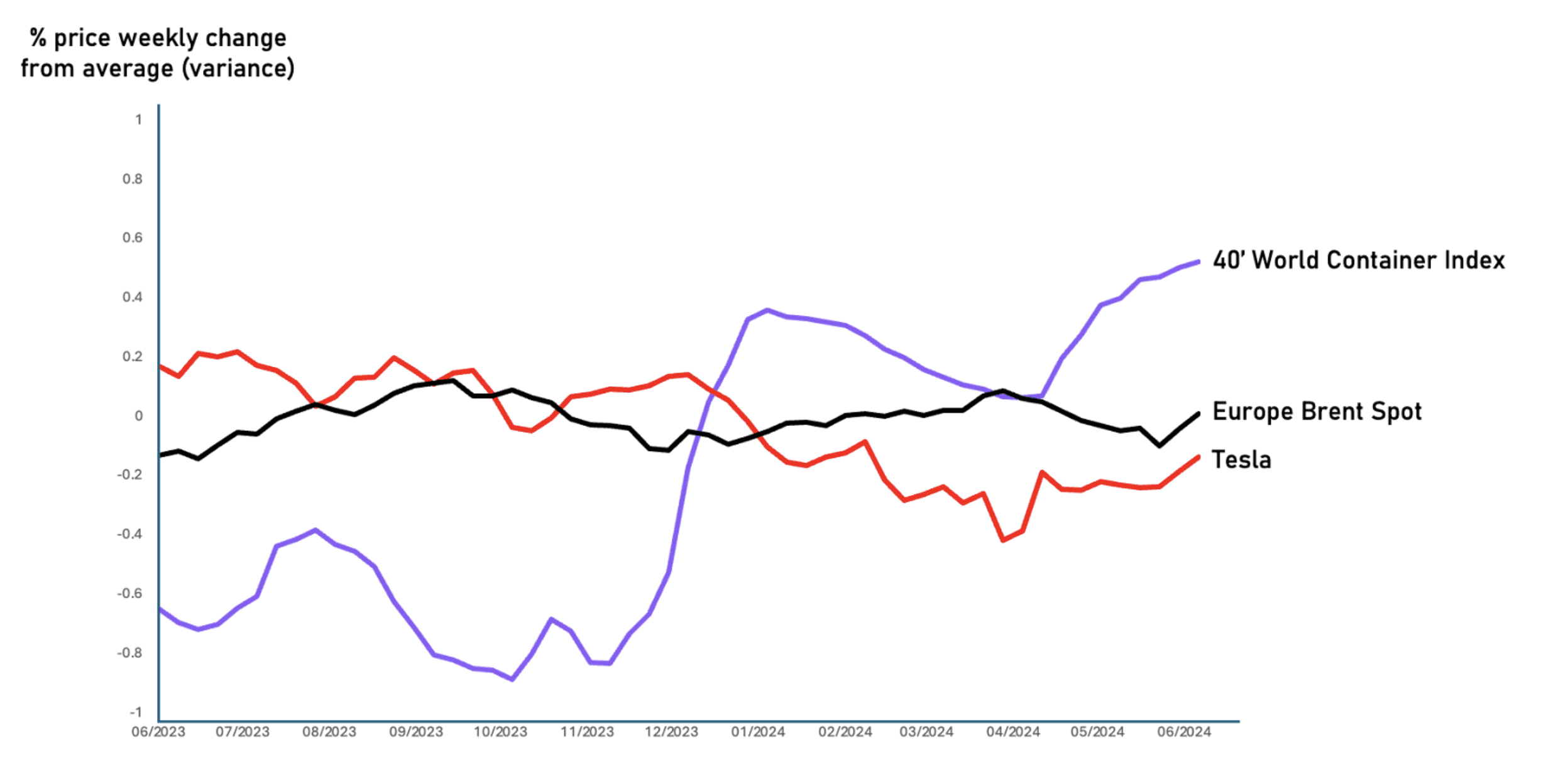

At Prodensus we sat down to analyze this question and reviewed one full year of data from June 2023 to June 2024. We reviewed the Drewry 40’ World Container Index (WCI), which is the average spot price paid for a container globally as our starting point. We then picked what the market would consider 2 volatile indices in very different sectors as a comparative, European Brent crude oil and Tesla.

The results show that the 40’ WCI varied massively over the last 12 months. In fact prices moved from a weekly average low of $1,342 to a high of $5,318. This level of volatility means that 40’ container spot prices are about 2.7 times more volatile than Tesla and 7 times more volatile than European Brent!

The Sentiment Towards Freight: Why Is It So Volatile?

Several factors contribute to the current volatility in freight:

Supply and Demand Imbalance: Despite a record increase in nominal capacity from new deliveries, effective demand continues to outstrip supply on major trade lanes like Asia-Europe and the trans-Pacific. This imbalance leads to significant fluctuations in freight rates.

Port Congestion and Equipment Shortages: Congestion in key ports and a shortage of container equipment have further exacerbated the situation. For instance, container equipment prices have surged, with average prices for a 40-foot-high cube container in China more than doubling in recent months.

Geopolitical and Economic Uncertainties: Events such as labor strikes, geopolitical tensions, and changes in trade policies contribute to the unpredictability of the market. Shippers are increasingly frontloading cargoes to avoid potential disruptions, leading to erratic demand patterns.

Technological and Operational Shifts: As companies like Amazon and Walmart set new standards for logistics operations, other shippers are compelled to adapt, often leading to short-term cost increases as they invest in new technologies and processes.

Traditional vs. Dynamic Approaches to Freight Procurement

In the world of stocks, no savvy investor would consider making a single purchase and then ignoring market fluctuations for the rest of the year. Instead, they adopt dynamic strategies, continuously monitoring market conditions and adjusting their portfolios accordingly. This same logic should apply to freight procurement. By treating freight as a dynamic commodity rather than a fixed cost, companies can better navigate the frequent shifts in the market.

Traditional annual contracts may provide a sense of security, but they fail to account for the rapid changes in freight rates. Just as a stock broker wouldn't place all their investment in a single stock at one point in time, shippers should avoid the pitfall of annual freight contracts. Instead, adopting a more flexible procurement strategy, such as quarterly negotiations or even spot market purchases, could prove more beneficial in managing costs and ensuring capacity.

The Path Forward

For companies involved in freight procurement, embracing a more dynamic approach is essential. This means continuously monitoring market conditions, leveraging data analytics for better decision-making, and maintaining flexibility in their logistics operations. By doing so, they can mitigate risks and capitalize on opportunities as they arise, much like a savvy stock broker navigates the market.